Why Everyone’s Suddenly Paying Attention to USDA Livestock Insurance—And What It Signals for AgTech

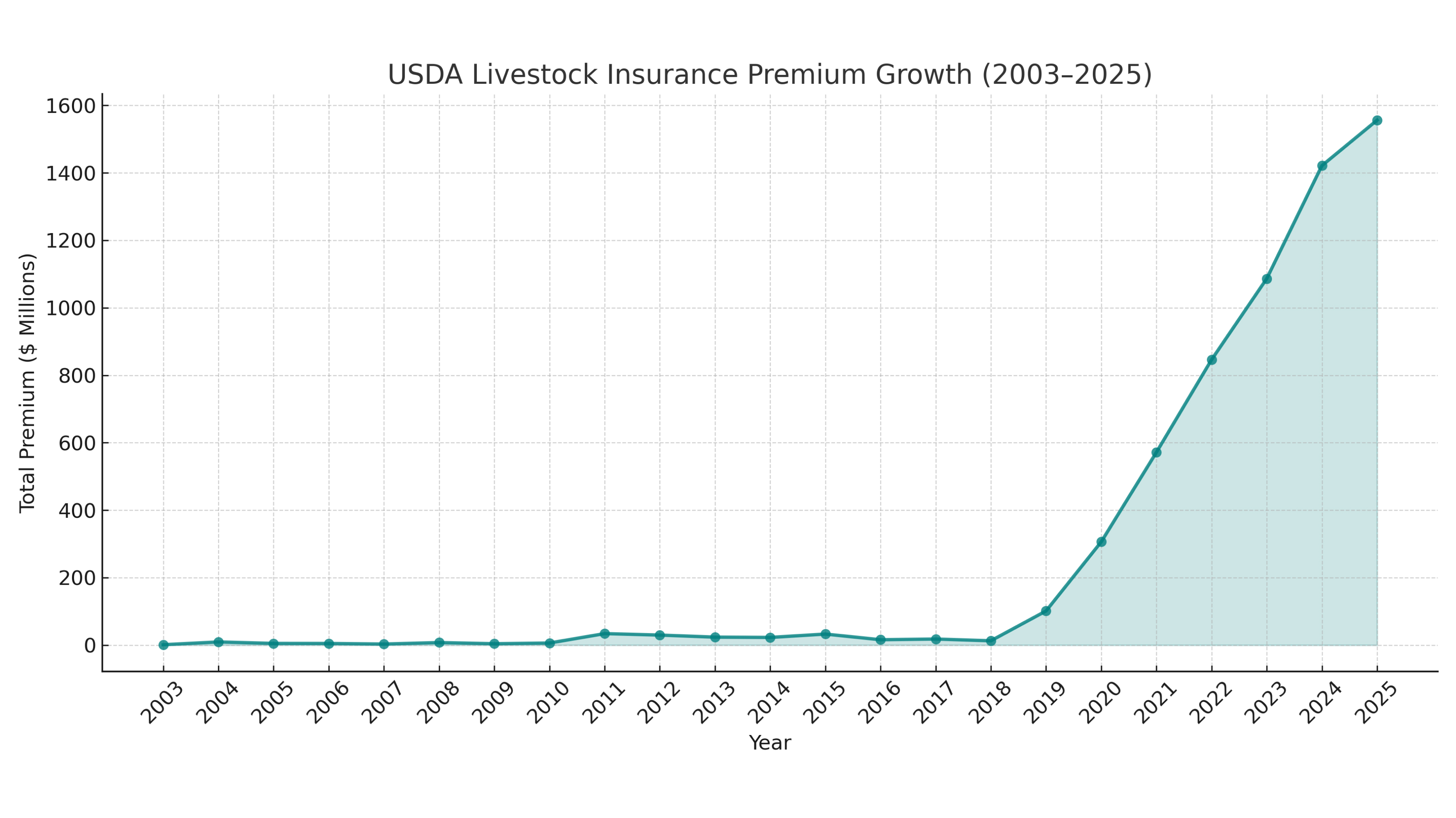

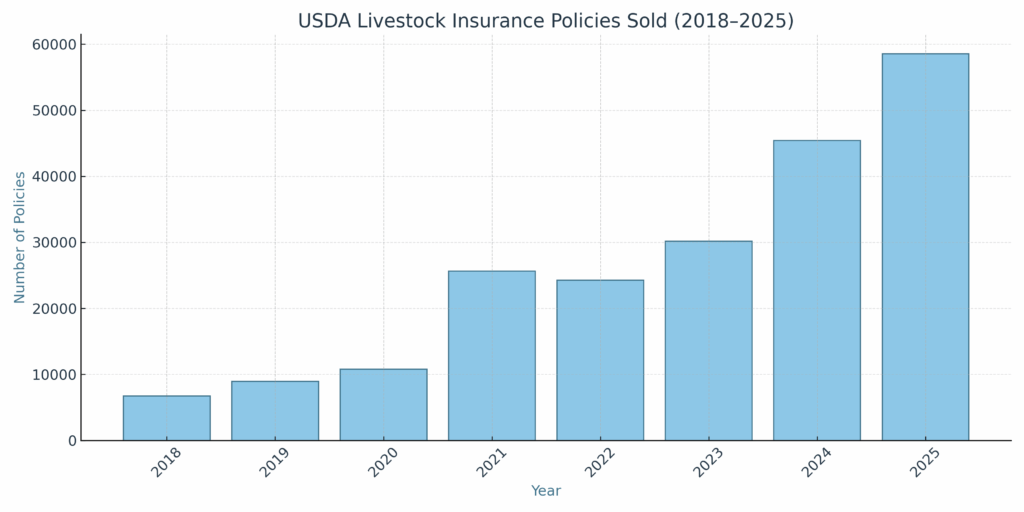

In just the last 7 years (2018 to 2025), premiums jumped from $6.7 million to over $1.5 billion — a 224x increase in less than a decade. So, what happened?

If you haven’t been watching USDA livestock insurance trends over the past two decades, you’ve missed a quiet but massive shift — one that’s reshaping how agricultural producers manage risk, and opening the door for serious innovation in agtech.

In 2003, total livestock insurance premiums paid into USDA-backed programs amounted to just $1.2 million. Fast-forward to 2025, and that number is projected to reach over $1.5 billion.

Let’s pause on that.

From $1.2 million → to $1.5 billion in 22 years. That’s over a 1,200x increase.

But even more striking?

In just the last 7 years (2018 to 2025), premiums jumped from $6.7 million to over $1.5 billion — a 224x increase in less than a decade.

So, what happened?

A Quick Refresher: What Is USDA Livestock Insurance?

The USDA’s Risk Management Agency (RMA) offers insurance products like Livestock Risk Protection (LRP) and Dairy Revenue Protection (DRP) to help producers lock in future prices for cattle, swine, and milk. Think of it like hedging, but designed for the realities of farming and ranching.

Premiums are partially subsidized, and payouts are triggered if market prices fall below the insured value. In theory, it’s a safety net — but in practice, it’s becoming a strategic tool.

Why This Matters for AgTech (And Us)

At Ashbrook Technologies, we build solutions that modernize agriculture. Watching USDA insurance premiums climb year after year tells us something important:

Producers are increasingly willing to invest in tools that protect their operations.

But let’s be honest — USDA programs aren’t known for being simple. That complexity creates opportunities. As participation grows, the need for user-friendly tech solutions becomes unavoidable:

- Interfaces to quote and compare insurance options

- Automation to track coverage, payments, and deadlines

- Data layers to overlay market prices, weather trends, and risk exposure

The system isn’t just growing — it’s ripe for disruption.

Is This a Bubble? Or the New Normal?

There’s room for skepticism. Some of this growth may be tied to rising commodity prices, more aggressive subsidies, or policy shifts that won’t last. But even if those tailwinds fade, one thing is clear:

Producers are no longer relying on hope alone.

They’re budgeting for risk. They’re buying protection. And they’re looking for smarter ways to do it.

At Ashbrook, we see this as validation: risk management isn’t just an insurance conversation — it’s a technology challenge. And we’re here to meet it.